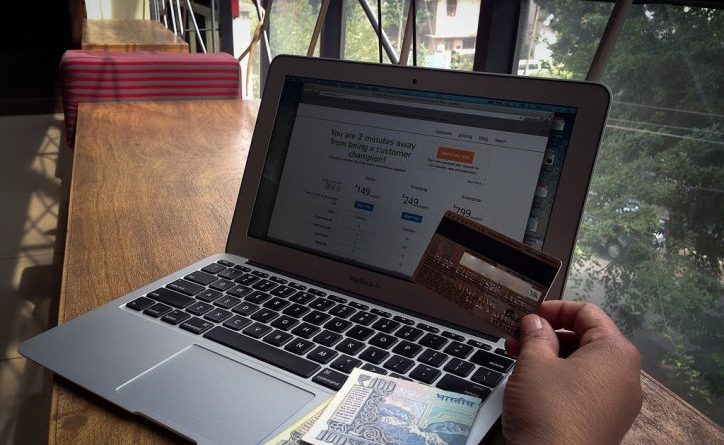

With our fast paced development in electronics, the majority of people make use of online banking. It’s the fastest and easiest and one can have access to your bank everywhere, like on your smartphones, tablets, notebooks and computers. Due to the easy access we need to protect ourselves from unauthorized persons, like scammers and identity theft.

The necessary protection on how to protect yourself against fraudsters would be to:

1. Protect your devices with a secure password

A secure password would be one consisting of personal information which only you know along with symbols and case-sensitive letters. This will stop others from accessing your device when lost or stolen.

2. Have anti-spyware and virus protection software loaded on your devices

This does not only protect you from online hackers but your devices software too. How to protect yourself, this software will keep all your information and personal data safe.

3. Ensure you access your bank account from a secure network

Ever heard of “hotspots” or free internet in a restaurant or cafe? Well these are not very secure networks; through these networks your information can be accessed. How to protect yourself, you should rather confirm from places like these if their networks are safe otherwise I would recommend trying to make use of your own.

4. Only use the official banking websites

Online there are numerous sites claiming to be to the one you’re seeking for. How to protect yourself, make sure you’re on the official website of the financial institution by checking that the URL starts with “http” and site is marked secured.

5. Never confirm personal information through emails

Financial institutions do not ask for personal information through emails. There are scammers out there that send out these types of emails to get your personal information. Never respond to these types of emails. To confirm the request I’d advise you to contact your bank personally.

Knowing all this and dealing with these scams can have its toll on you. When time comes when you are unsure if your personal information has been stolen, there are methods on how to protect yourself which you can use to confirm and determine what actions to take to re-instate control over your accounts.

6. Review bank statements for unknown charges

Reconcile your bank statements for your current and credit card accounts, if any, monthly. This would let you pick up on unknown amounts charged to your accounts. When you do find unknown transactions call your bank to confirm and inform them of these transactions and if they are not yours asked them to be reversed. The bank would advise you to do card replacements.

7. Receiving mail and calls from unknown debt collectors

When receiving statements and calls from debtors unknown to you is a sign that your personal information has been compromised. Try getting as much information from the debtor and report the theft to the authorities to help catch the thief.

To stay protected and safe always report irregularities on your bank statements, and follow up on unknown debts.

Featured Image: Photo by Ritesh Nayak / CC by