-

Since the economic crisis in 2008, it has become increasingly clear that borrowers with lower credit scores are more likely to default on their loans than people with high scores. Due to this risk, the requirements for credit scores have become stricter. Individuals with bad credit scores are less...

-

Everyone has heard that their credit score has an effect on their eligibility for loans and other financial Credit score can greatly affect the amount of money that a bank will loan and the interest rate that the money is loaned at. Different types of loans will be more...

-

We strive earnestly maintain a positive credit status. However, sometimes we may find ourselves in circumstances that can adversely affect our credit status like divorce, unmanageable bills and bankruptcy. Regardless the causes of a poor credit score, it is always possible to redeem it and enjoy other financial privileges....

-

If you’re in the process of starting a new small business and are hoping to open a business checking account, you need to ensure that your own personal finances are in order. If you are one of the millions of people around the US with a poor credit report,...

-

Starting a business is not a simple task; you put a lot at stake, including the entire investment amount. And you often require a lot more money to expand your business, and at times like these, it may be a sound idea to make use of a business credit...

-

Your credit score is always used by lenders to help to determine whether or not any applications you make for personal loans, credit cards, mortgages or any other form of borrowing, will be approved. But how do you find out what it is? We break down how to check...

-

When it comes to applying for a loan, your credit is one of the most important factors; any responsible lender or organization would want to make sure you can comfortably afford to manage any new borrowing without overstretching. Many at times, relevant information on your personal file is used...

-

Consumers should get a copy of their credit report and review it periodically. A good rule is once every four months. One should read the report and notice activity it describes. One should look at it carefully to ensure that it is accurate. Businesses and employers use Credit reports...

-

When it comes to getting auto insurance, you factor in things that you know are important—the make and model, good student discount, and if you’re accident-free. But did you know that you also need to factor in your credit score? Most states use your credit score to determine your...

-

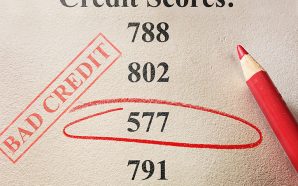

Credit scores range from a low of 300 to a high of 850 for both FICO and Vantage Score rankings. The companies that determine credit scores don’t label specific scores as good or bad. Even credit reporting agencies merely review the current market for an idea of what constitutes...